The USDX (ticker DXY) is “a live measure of the performance of the US dollar against a basket of other currencies”. If we are to interpret it in terms of investment, then it is quite similar to stock investment, but instead of stocks, you buy or sell the US dollar versus a basket of currencies (which at the moment consists of the euro, the British pound, the Swiss franc, the Canadian dollar, the Japanese yen, and the Swedish krona).

For example, if the DXY’s value was 100 at the beginning of a year, and at the end of the year, its value was 110, that would equate to a gain of 10%. If you had bought dollars for this basket of currencies at the beginning of the year, then you would have had a gain of 10% for your investment – again, in terms of that same basket of foreign currencies.

The USDX is useful for the evaluation of FX trading strategies and portfolios because it’s already cleared of the interest rates and we may say that it presents the potential alpha in the FX market in its purest form.

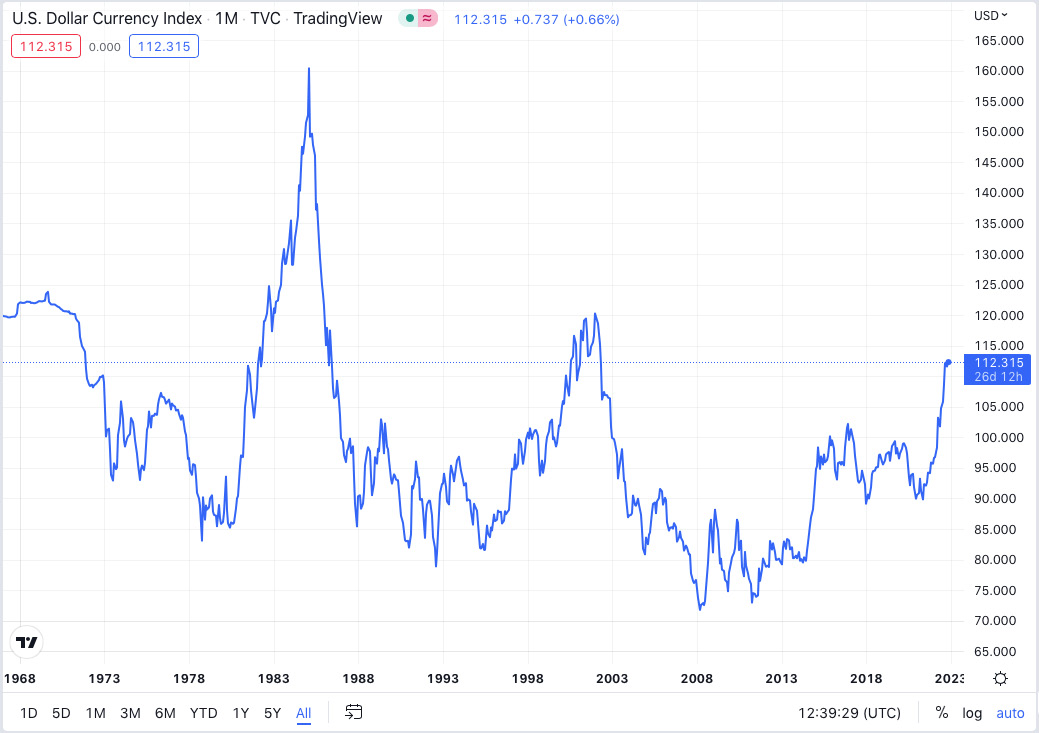

If we look at the historical values of the USDX in the following chart, we can see that quite unlike the S&P 500, it cannot be used as a long-term investment – the same as is the case with any single currency:

Figure 9.2 – Historical chart of the USDX (chart by TradingView)

Generally speaking, if you outperform this index by manipulating the currencies in it (buying, selling, or adjusting proportions in the basket), you generate alpha relative to this index.

The USDX is not the only FX index. Many large institutions offer their own indices that aim to evaluate various segments of the FX markets or even various trading or investment approaches. Let’s have a look at a few indices provided by the most important international banks, as these indices are frequently used as benchmarks not only for passive investment but also for active trading.

Leave a Reply