In general and brief, a limit order is an order to buy or sell the specified amount of the asset at the specified price or better.

What does better mean here?

This means that if I send a limit order to buy EURUSD at 1.0100, then any price below 1.0100 will match my order. On the contrary, if I send a limit order to sell EURUSD at 1.0100, then any price above this level will match. In other words, by using a limit order, I say that I am ready to buy or sell at any price no worse than the one specified in the order.

What happens if you send a limit order at a price that is better than the current market price? For example, a buy limit order at a price that is below the current ask? Well, it depends on the particular implementation of limit orders used by your broker or execution venue. If you trade at an exchange (for example, if you trade currency futures), then your order will be routed directly into the order app.

If you trade spot or forward contracts, then most likely, such an order will reside in the trading venue’s system until the market price touches the order level and then the order will be converted into a market order. If the market price never reaches the order level, the order may be canceled or may reside in the broker’s order app virtually forever (actually not forever, of course, every broker has their own rules on what to do with forgotten limit orders).

What happens if we send a limit buy order at a price that is worse than the current market price – for example, a buy limit order at a price that is above the current ask? In this case, the order will be executed immediately, and it will start absorbing the liquidity from the order app level by level, pushing the price higher and higher, but this process will stop as soon as the limit price is hit. Thus, a limit order sent at a price worse than the market can be considered a market order with protection.

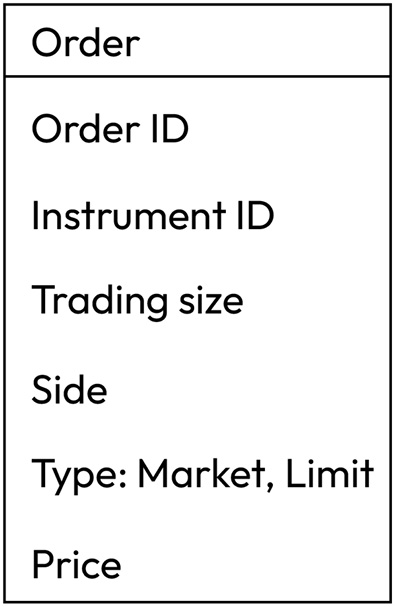

Now we know that besides market orders, we can use limit orders, and in case we use them, we should specify a new field in our order ticket prototype: order price.

Figure 10.6 – Price attribute added for stop and limit orders

So far, it looks like limit orders are the best to use in all situations, but is it really true? Of course, as there’s neither a free lunch nor a Holy Grail in trading, limit orders are no panacea to execution issues. Let’s take a deep dive into this domain, as execution issues with limit orders are far less obvious than those of market orders.

Leave a Reply