Of course, the main execution issue with stop orders is similar to that of market orders: the slippage with stop orders is potentially unlimited. If we send a buy-stop order, then it will be executed at any price equal to or greater than the order price. It is similar to a sell-stop order: it will be executed at any price equal to or less than the order price.

Stop orders guarantee execution but do not guarantee the price – and in this sense, they are somewhat similar to market orders. Let’s go back again to Figure 6.2 in Lesson 6, Basics of Fundamental Analysis and its Possible Use in FX Trading, which illustrates the sequence of ticks (trades) around the publication of US NFP data. Imagine we have a long position before the news and we set a protective stop (stop-loss) order at 1.02250. With the very first tick after the news release, this stop order will be executed – but not at 1.02250. It will be executed at the first available price, which would be 1.02100 or worse (lower).

Always remember that even if you placed a stop-loss order, it doesn’t mean that you limited your losses by the order’s price level. It can be executed way beyond the requested price, thus increasing the losses.

It’s worth mentioning that some market makers offer guaranteed stop-loss execution. This means that during an event such as US NFP or a similar situation when the price may jump beyond the stop order price in one tick, they would still execute the order at the requested price, not the market price. Only market makers can do that as it is they who quote the market for you as the price taker. Of course, there’s no free lunch here either, so market makers ask for a premium for this service. Such a premium typically means a wider spread or a greater commission.

Does it make sense to use guaranteed stop-loss orders? Well, it depends on the trade logic of your model and its statistics. If you use stop orders as a regular means of exiting the position even in a calm market, then the answer is probably no because you will lose more in spreads and commissions. If you use them only as a protective measure against an unexpected disastrous market price movement, then the answer is probably yes, as such a disastrous movement can ruin your account in one tick – just recall the case of the Swiss National Bank unpegging the rate of CHF from the euro described in Lesson 9, Trading Strategies and Their Core Elements, in Figure 9.6.

With all that in mind, stop orders kept at the broker are mostly used as protective stop-loss orders, which exit from a losing position and cut running losses. If your strategy logic assumes entering the market along with the price movement, which is typical for a breakout strategy, for example, then it’s always a better idea to emulate such a stop order locally and send it to the market as a market or even a limit order to prevent bad execution.

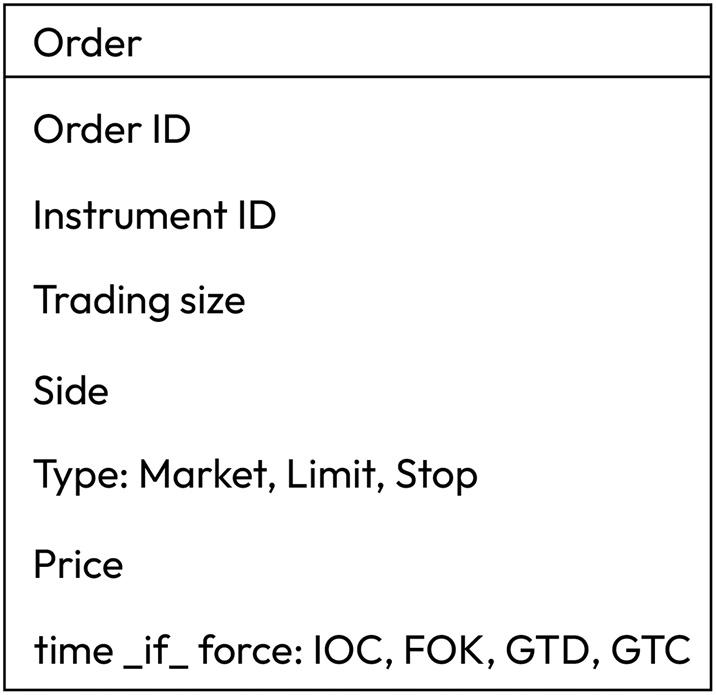

Now, we can suggest the final draft of our general order ticket, which would support all three main types of orders (market, limit, and stop) and all the essential attributes required to send the order to a broker:

Figure 10.8 – All types of orders are now supported in the order ticket

Similar to limit orders, IOC and FOK are not used with stop orders, but GTD and GTC are. Besides that, some execution venues offer an additional condition to trigger a stop order, which is to convert a stop order into a market order: whether it’s triggered when the bid or the ask price hits the order level. However, this specifier is not common.

Market, limit, and stop orders are de facto standard orders accepted by almost any trading venue. However, some venues offer other types of orders that are frequently referred to as compound orders, which we will explore in the next section. They are not common and not essential, but it’s worth at least knowing that they exist and how they work in very general terms.

Leave a Reply